- Home

- Market Reports

- Product Reports

- News

- Companies

- Topics

- Events

- Subscribe

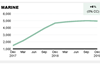

Dometic’s 2019 marine sales outpace other segments

> Subscriber-only, By Arlene Sloan2020-01-31T16:55:00

Swedish equipment maker Dometic has been downsizing capacity, headcount and SKU’s in a drive to improve efficiency and respond to soft demand in key markets

Dometic announced fourth quarter and year-end results today in a webcast from the company’s headquarters in Sweden, reporting annual net sales growth of 1% to SEK 18.50 billion (€1.74 bn) for the financial year ending December 31, 2019. Aftermarket sales for the year showed 11% growth.

Profit (after tax) for the year was SEK 1.33 billion (€125m) down -16% from 2018, reflecting lower volumes and the full impact of 25% tariffs, offset by a year of efficiency improvements, capacity reduction and pricing improvements.

Marine revenues, representing 27% of the company’s total annual sales, were the strongest performing segment for the company in 2019…

To continue reading our full report on Dometic’s marine business in 2019 along with highlights of President & CEO Juan Vargues’ discussion with analysts during today’s webcast, please see the options below for subscribing to our Premium content.

To continue reading this article…

Already registered?

Create a FREE account

To continue reading this article you must

register for a free account and login.

Subscribe to IBI Plus

Subscribe today and recieve

instant unlimited sitewide access.

- Subscribe

- Print Issues

- Topics A-Z

- Contact us

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- © 2024 BOAT INTERNATIONAL MEDIA LTD.

- Members of:

-

-

-

-

- Partners with:

-

-

- © 2025 Boat International Media Ltd.

- Topics A-Z

- IBI Magazine

- Terms & Conditions

- Privacy Policy

- Cookie Policy

- Subscribe

- Contact us

Site powered by Webvision Cloud

LinkedIn

LinkedIn X / Twitter

X / Twitter Facebook

Facebook Email us

Email us