As tariffs rise and environmental regulations tighten, the European marine sector grapples with mounting uncertainty

In this section

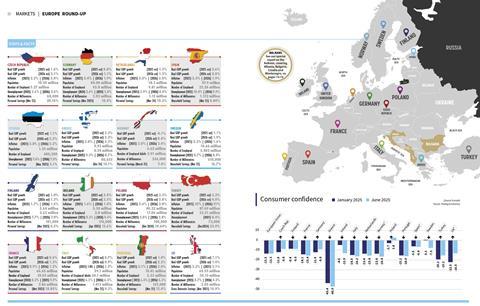

- Czech republic

- Estonia

- Finland

- France

- Germany

- Greece

- Ireland

- Italy

- Netherlands

- Norway

- Poland

- Portugal

- Spain

- Sweden

- Turkey

- UK

The European marine industry is navigating a period of deep uncertainty marked by shifting trade dynamics, environmental regulation, and affordability challenges. According to Philip Easthill, secretary-general of European Boating Industry (EBI), a combination of rising tariffs, disrupted trade flows, and tightening European and local legislation is putting pressure on the sector’s long-term stability and competitiveness.

Tariffs and Transatlantic Trade

A major concern for European boatbuilders and exporters continues to be the imposition of tariffs on exports to the United States. The recent joint trade announcement by EU Commission President Ursula von der Leyen and US President Trump in July 2025 has provided a level of predictability, but with a steep cost. Under the new deal, tariffs on recreational boat exports to the US will rise to 15% – up from previous rates of just 1-2%. The new tariffs, expected to cost the sector tens of millions of euros, arrive just ahead of the critical European boat show season.

While luxury remains resilient short-term, Europe’s broader marine industry faces growing challenges in 2025

Despite avoiding the escalation into a full-scale trade war, EBI has warned that the higher tariffs could destabilise many small and medium-sized enterprises in the sector. In 2023 alone, exports of recreational boats to the US were valued at around $1.8bn. A 15% tariff, according to EBI, risks creating an unbalanced transatlantic trade relationship and undermining EU competitiveness.

Philip Easthill emphasised: “The US is the most important export market for the recreational boating industry in Europe. Stability and predictability is vital, but equally important is a trading environment that businesses can sustain. This deal is not sufficient.”

EBI has urged the European Commission to consider the announcement as a starting point for more targeted, sector-specific negotiations. “We call on the EU Commission to consider the needs of export-reliant industries such as ours,” said Easthill.

The text of the EU-US agreement has not yet been made public, and EBI has stated it will offer a fuller assessment once the details are available. In the meantime, the association is committed to working with its members to navigate the implications and continue its advocacy efforts in Brussels. EBI reiterated the need for both the EU and US to focus on removing trade barriers and improving the regulatory environment for the boating industry.

“We’re seeing strong activity at the top of the market, but that doesn’t sustain the broader industry”

Environmental Regulation and Local Legislation

Beyond international trade, domestic and local environmental regulations are shaping the trajectory of the industry. Highly localised sustainability targets – such as Lake Constance’s 2040 net-zero emissions goal, which runs ahead of broader EU targets – highlight the growing complexity businesses must navigate. Additional measures aimed at seagrass preservation in the Mediterranean and stricter emissions compliance in some areas further add to the regulatory burden.

That said, EBI notes a shift in the tone of European-level policymaking toward what it calls “simplification”. While the EU still pursues ambitious environmental goals – including the 2040 target of a 90% reduction in emissions – some new initiatives are showing greater consideration for economic feasibility.

“It’s not quite deregulation, but simplification, and that’s certainly a positive move,” Easthill observed. “Many of the changes are aligned with what we’ve been advocating for.”

Top-End Growth vs Mainstream Struggles

The European market remains segmented. High-end motoryachts and semi-custom models in the 60ft-90ft range are performing reasonably well, supported by affluent buyers who are less sensitive to inflation and supply chain disruptions. However, this success masks deeper vulnerabilities in the mainstream and entry-level segments.

“We’re seeing strong activity at the top of the market, but that doesn’t sustain the broader industry,” Easthill cautioned. “If the sector becomes too focused on luxury, we risk losing the entry-level market –something we absolutely cannot afford.”

Inflation, increased production costs, and supply bottlenecks have pushed prices up, widening the affordability gap. Sailing boats and mid-tier vessels are experiencing reduced demand, and many first-time buyers are being priced out of the market.

To counter this, some manufacturers are beginning to reinvest in smaller, more accessible craft. “You need to get people to start boating on a small boat,” Easthill said. “That’s really important for long-term sustainability.”

Outlook

While the luxury segment continues to offer short-term resilience, the broader European marine industry faces mounting challenges in 2025. Tariffs on transatlantic trade, increasingly complex environmental regulations, and affordability pressures are weighing heavily on sentiment.

EBI remains actively engaged in shaping EU policy to reflect the realities faced by boat builders and exporters. The current moment is seen as a critical opportunity for lobbying and negotiation – before the full consequences of trade deals and regulatory changes become locked in.

The path forward will require coordinated efforts at both the EU and national levels to reduce red tape, foster investment, and promote a more balanced, sustainable market structure. With further developments expected in the coming months, particularly around the release of the full EU-US agreement text, the sector will be watching closely.

Topics

Choppy waters ahead as Europe faces trade, regulation and affordability pressures

As tariffs rise and environmental regulations tighten, the European marine sector grapples with mounting uncertainty

Currently

reading

Currently

reading

Choppy waters ahead as Europe faces trade, regulation and affordability pressures

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

LinkedIn

LinkedIn X / Twitter

X / Twitter Facebook

Facebook Email us

Email us